New Paragraph

Research

After a record-setting 2022, which saw a peak in shareholder proposals—especially climate-related ones—across Europe and Japan, our portfolios have experienced a slowdown in such proposals. However, these proposals have grown in complexity and shifted in terms of proponents and topics, demanding heightened scrutiny. Several factors contributed to the increasing complexity of proposals, including the expanded variety of proponents, and the fragmentation of acceptable norms across our society. Evolving Priorities: Governance and Social Issues Take Center Stage A notable shift in priorities emerged in 2024, with a renewed focus on governance and social topics. This change is partly attributable to increasing global regulations over the past two years, which aimed to expand disclosure and transparency. Across our portfolios, governance-related proposals constituted 50% of all shareholder proposals this year, a significant increase from 33% in 2022. Furthermore, social matters have now surpassed environmental and climate-related proposals in prominence, marking another departure from prior years. The precise drivers behind these trends remain unclear but could stem from shifts among proponents, influenced by political rhetoric, or a reordering of priorities among investors. Broader Trends and Declining Support Interestingly, the trends observed within our portfolios are corroborated by broader statistics from ProxyMonitor. Analysis of all shareholder proposals submitted at Annual General Meetings (AGMs) over the past 18 years reveals that, while the overall number of proposals has stabilized since its 2017 peak of over 800, the average support for these proposals has steadily declined since 2021, reaching a historical low of 17% in 2024, down from a peak approval rate of 33% in 2021.

The retail apocalypse is still alive, but there are opportunities for retailers to thrive. As of the end of October 2024, retailers in the United States had announced nearly 6,200 store closures for the year, This marked the highest number of closures since 2020 and reflects an evolving consumer landscape where shoppers are increasingly budget-conscious and prioritize experiences over material goods.

Who can survive and thrive in this environment?

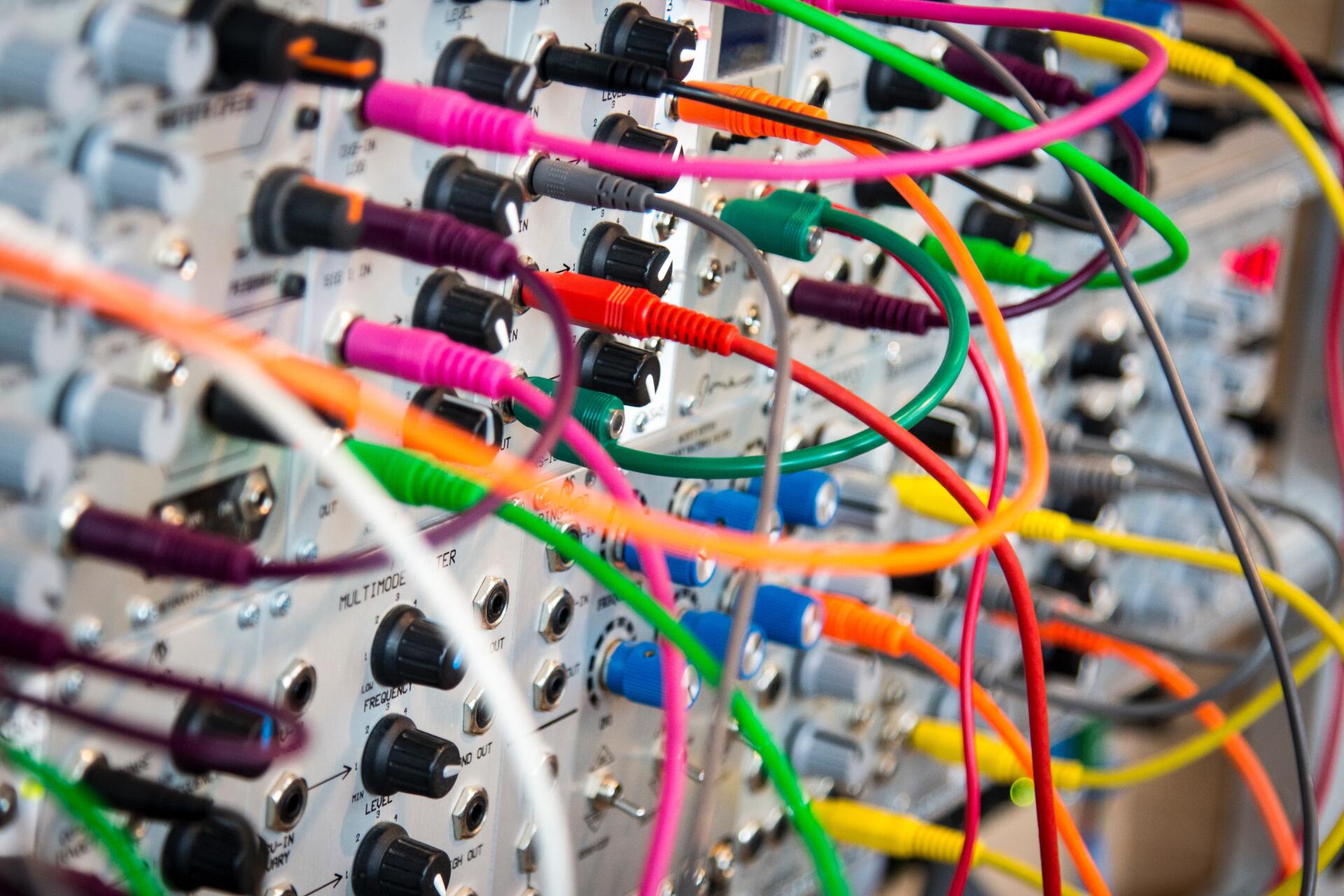

There are no doubts that, when it comes to financial disclosure, we have moved from the well-intention phase into the show-me-the-numbers phase. Asset owners and regulators are asking asset managers, who are asking issuers, who are asking their suppliers, and everyone along the way, an ever-increasing amount of information. They want it all and they want it now, from climate data and strategy to employee data, or board relationships and competencies. Transparency will be the key theme for 2021 and beyond, and with that increased transparency will come, one shall hope, more accountability.

Bringing sustainability into strategic and tactical decision making has pushed us to take a hard look at what we do, why and how we do it, within a context that goes beyond an organization’s own boundaries. Institutional investors’ quest for better governance seems legitimate and the merits of investors’ push for improved corporate behaviour and accountability is hardly disputable. But what’s in it for smaller players, including retail investors, the ultimate beneficial investors, or small and mid-sized businesses, who seem to have been left out of the discussions? Let's explore the good, the bad and some of the unintended consequences of our battle for sustainability in business.

While the concept of "sustainable development" was first introduced in the 1970s and more clearly defined in the 1980s, it really gained momentum over the past two decades with the successive economic and ecological crises. It has now taken the investment community by storm, and successfully carved out a place of choice in investors' mind, on boards’ agenda, and at corporate strategic forums. Asset owners, asset managers, investment research teams, regulators, and citizens are all participating in reshaping the financial industry, by redefining its purpose and its expected contribution to our evolving societies. While many have been drawn into the discussion, willfully or not, polarization seems to have reached paroxysm. While these diverging views may appear irreconcilable, increasing transparency and mutual learning will bring us closer to each other, and faster than we think.